So, where is everybody? How Bitcoin solves Fermi Paradox

Roughly eighty years ago, physicist Enrico Fermi and his colleagues pondered the existence of intelligent life beyond ourselves.

Read articles by starfish authors on Bitcoin, Economics, and Liberty.

Roughly eighty years ago, physicist Enrico Fermi and his colleagues pondered the existence of intelligent life beyond ourselves.

As soon as the spot Bitcoin ETF was approved by the SEC in January this year, I wrote here about this important step for the institutional adoption of Bitcoin in the United States, also addressing the short- and long-term risks involved with this type of financial product. Now that, unexpectedly and through political pressure, the SEC has also approved the spot Ethereum (ETH) ETF, I will go into detail about how I believe the competition between these different ETFs will play out in the market.

We caught up with Konsensus Network editor Philip Charter to talk about his new book 15 Shades of Time.

Absent government coercive controls, people and markets in general will always prefer to use hard rather than soft money. In situations of freedom, the strong money “drives out” the soft money.

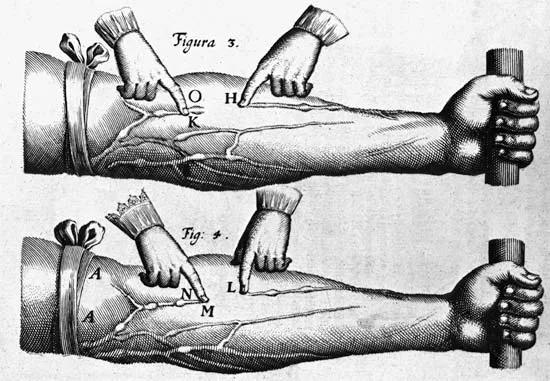

William Harvey demonstrated the mechanism of blood circulation in the 1620s, demolishing ancient and medieval knowledge about the body’s humors.

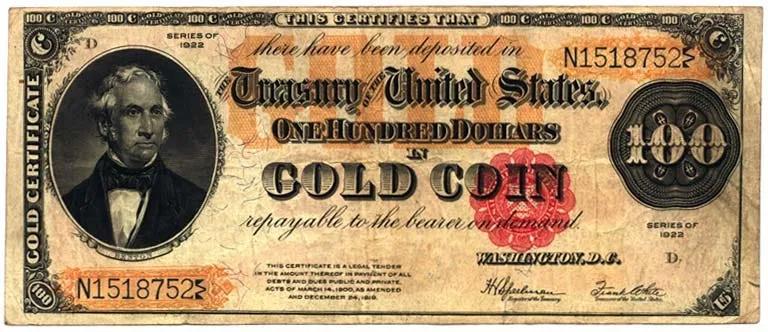

'Money is gold, everything else is credit' John Pierpont Morgan in 1912.

Darwin's most famous quote comes from On the Origin of Species: 'It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.'

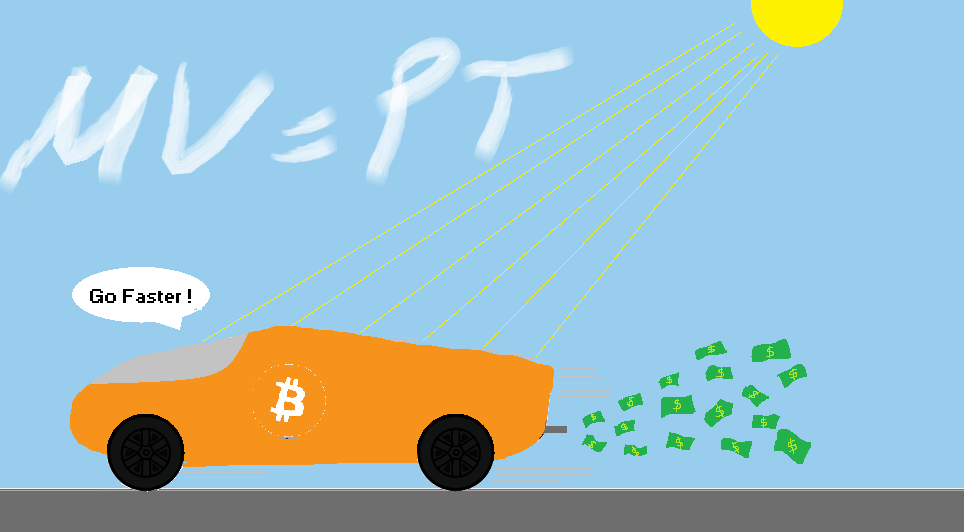

For money to have meaning it needs to have a relationship to energy. The energy used to produce money becomes a physical representation of the time required to earn it. When money requires no energy to produce, it has no relationship to time.

In a monetary system where money is no longer backed by a tangible asset (as was the case with the gold standard) but controlled by the authorities through legal tender laws and a monopoly on money creation, this is, according to the author, a form of counterfeiting on a massive scale.

An Introduction to Bitcoin is an attempt to explain as many of the pieces of the puzzle, within the confines of a small book. It is a guide, if you will, for those who wish to walk the path laid out for us by Satoshi Nakamoto.

Mainstream economic teaching still pushes the basic belief that inflation occurs when the aggregate quantity of goods demanded at any particular price level rises more quickly than the aggregate quantity of goods supplied at that price level.

It is not weird that various religions have gained a foothold in the minds of man when we realize that each and every one of us comes into being by some very improbable means. You are a descendant from a very long lineage of happenstances.

With the word ‘inflation’ consistently in the news and part of our daily conversation, let’s explore the policy of Fiat currencies and a well-documented historical account of good old-fashioned currency debasement.

Is our civilization on the brink of collapse? What can we learn from the fall of the Roman Empire? Abundance Through Scarcity author Ioni Appelberg explores the rise and fall of civilizations, and the lessons we can learn from history.

Bitcoin miners are the dung beetles of the energy world and the ultimate waste reduction tool. As long as there is waste in the energy sector, there will be economic incentives to mine bitcoin with the energy that no one else wants or can use.

Before conquering Mars, we need to conquer outer space. For only in outer space can we have global control over the planet below, the hallmark of a Type 1 status civilization on the Kardashev scale.

Most people prefer custodial convenience over personal responsibility, resulting in bitcoin IOUs and paper-based shenanigans. And you know what? That's fine.

Bitcoin became the steady signal in the noise-filled landscape of the internet. It brought with it the possibility of peer-to-peer online commerce on a global scale. It broke down barriers, bypassed intermediaries, and allowed individuals to transact freely, securely, and without fear of censorship.

Beyond bitcoin's status as a speculative investment, there exists a compelling argument for actively wielding it, unlocking and embracing the power it bestows upon individuals and communities alike.

Understand the destructive power of inflation. Discover the consequences of central planning, theft, declining wages, and rising inequality. Break free from a broken system with the orange pill.

Bitcoin is the latest upgrade to hard money — a new, massless element that, unlike gold, is absolutely scarce. Gold is only relatively scarce, and like other elements, it’s infinitely available. Bitcoin is a mathematical element that has emerged as money from the free market due to its unbreakable and undeniable properties.

What did you learn about money in school? Could you explain money in one sentence? Go on, think about it for a while. If you can't, read on.