AI, Bitcoin and Gresham's Law

Absent government coercive controls, people and markets in general will always prefer to use hard rather than soft money. In situations of freedom, the strong money “drives out” the soft money.

Guilherme Bandeira a PhD in philosophy and legal theory from the University of São Paulo (USP), an LL.M in Legal Theory from New York University (NYU), a bachelor's degree in law from Fundação Getúlio Vargas (FGV) and a B.S. in philosophy at the University of São Paulo (USP).

Absent government coercive controls, people and markets in general will always prefer to use hard rather than soft money. In situations of freedom, the strong money “drives out” the soft money.

As soon as the spot Bitcoin ETF was approved by the SEC in January this year, I wrote here about this important step for the institutional adoption of Bitcoin in the United States, also addressing the short- and long-term risks involved with this type of financial product. Now that, unexpectedly and through political pressure, the SEC has also approved the spot Ethereum (ETH) ETF, I will go into detail about how I believe the competition between these different ETFs will play out in the market.

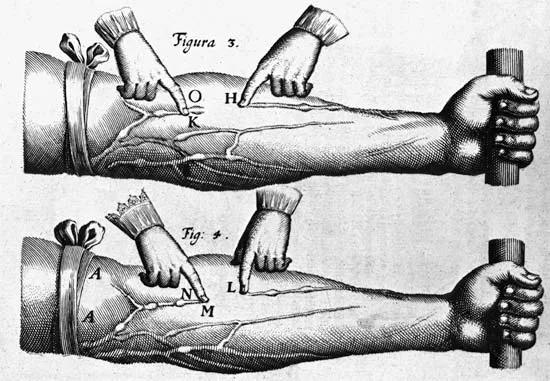

William Harvey demonstrated the mechanism of blood circulation in the 1620s, demolishing ancient and medieval knowledge about the body’s humors.

Roughly eighty years ago, physicist Enrico Fermi and his colleagues pondered the existence of intelligent life beyond ourselves.

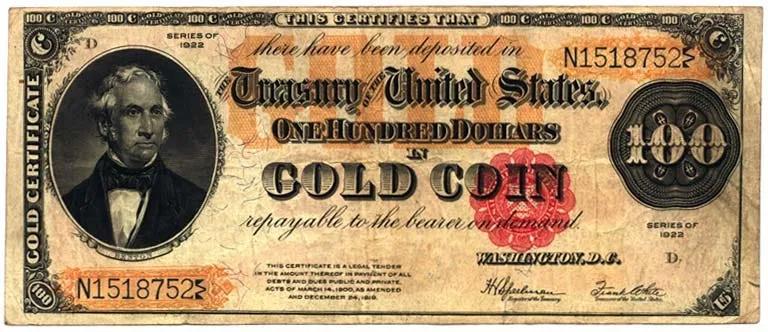

'Money is gold, everything else is credit' John Pierpont Morgan in 1912.